Unlock The Potential Of Japan’s Small Cap Value ETF: Your Path To High Returns And Growth Opportunities

Japan Small Cap Value ETF: Unleashing the Potential of Japanese Small Cap Stocks

Introduction

Dear Japan Enthusiast,

1 Picture Gallery: Unlock The Potential Of Japan’s Small Cap Value ETF: Your Path To High Returns And Growth Opportunities

Welcome to the world of investing in Japan’s small cap stocks! In this article, we will explore the Japan Small Cap Value ETF, a powerful investment tool that enables you to tap into the potential of the Japanese small cap market. This comprehensive guide aims to provide you with valuable insights and information on this ETF, giving you the confidence to make informed investment decisions.

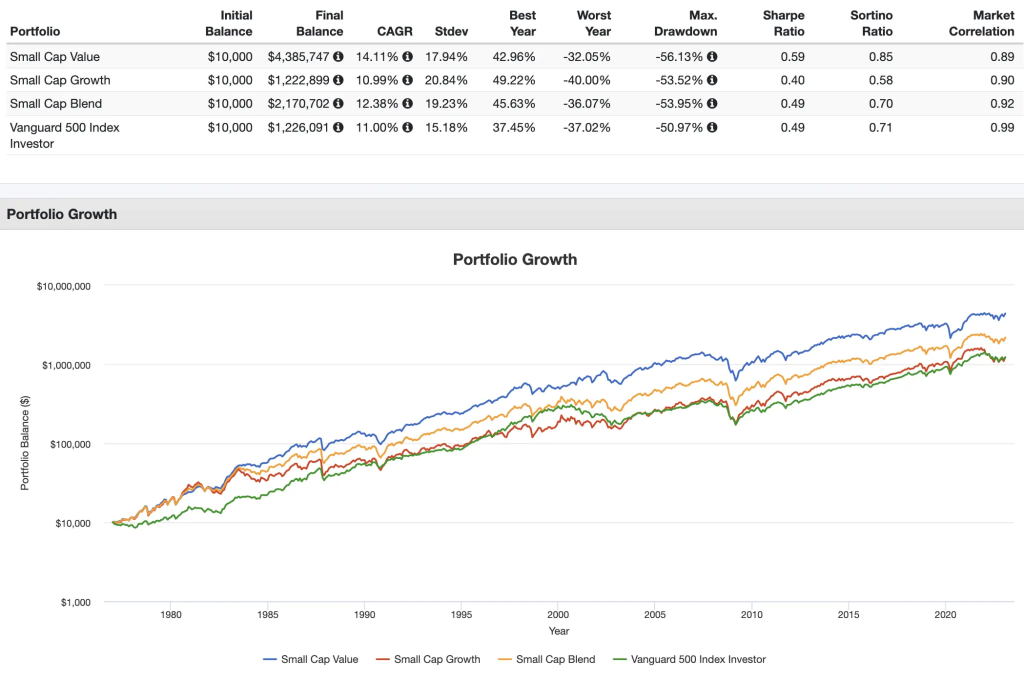

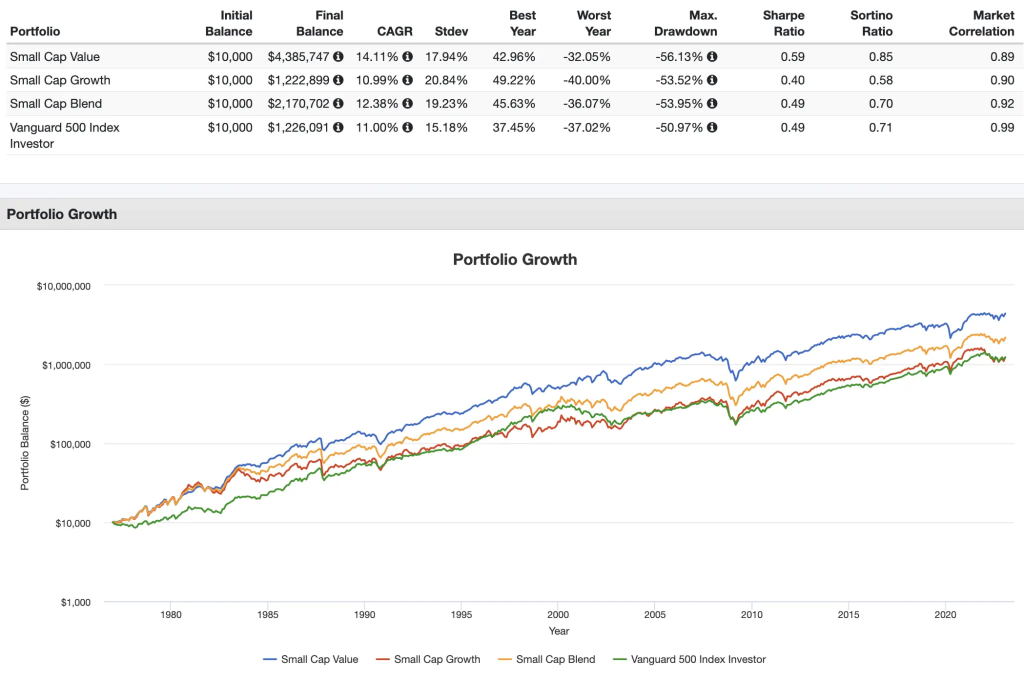

Image Source: optimizedportfolio.com

So, let’s dive in and discover the exciting opportunities that lie within the Japan Small Cap Value ETF!

What is Japan Small Cap Value ETF?

The Japan Small Cap Value ETF is an exchange-traded fund that focuses on investing in small cap stocks listed on Japanese exchanges. It aims to track the performance of an index composed of Japanese small cap companies that exhibit value characteristics. This ETF provides investors with a diversified exposure to the Japanese small cap market, allowing them to participate in the growth potential of these companies.

🔍 Key Point: The Japan Small Cap Value ETF offers investors an opportunity to gain exposure to undervalued small cap stocks in Japan.

Who Should Consider Investing in Japan Small Cap Value ETF?

The Japan Small Cap Value ETF is suitable for investors who are seeking exposure to the Japanese small cap market and believe in the potential of undervalued stocks. This ETF can be particularly attractive for investors with a long-term investment horizon and a higher risk tolerance. It is important to note that investing in small cap stocks can be more volatile compared to larger companies, so investors should carefully assess their risk appetite before considering this investment.

🔍 Key Point: The Japan Small Cap Value ETF is ideal for investors with a long-term investment horizon and a higher risk tolerance who believe in the growth potential of undervalued small cap stocks in Japan.

When Should You Invest in Japan Small Cap Value ETF?

The timing of investing in the Japan Small Cap Value ETF can be influenced by various factors, such as market conditions, economic outlook, and your own financial goals. It is essential to conduct thorough research and analysis to identify opportune moments for investment. Additionally, as this ETF focuses on small cap stocks, it may be favorable to invest during periods of economic recovery or when there are positive prospects for smaller companies.

🔍 Key Point: Consider investing in the Japan Small Cap Value ETF during periods of economic recovery or when there are positive prospects for small cap stocks.

Where Can You Access Japan Small Cap Value ETF?

The Japan Small Cap Value ETF is available for trading on various stock exchanges and can be accessed through brokerage accounts or investment platforms. Investors can consult their financial advisors or research online platforms to find the most suitable channels for investing in this ETF. It is crucial to choose a reputable and well-established platform to ensure the security and reliability of your investments.

🔍 Key Point: The Japan Small Cap Value ETF can be accessed through brokerage accounts or investment platforms, ensuring a wide range of options for investors.

Why Invest in Japan Small Cap Value ETF?

Investing in the Japan Small Cap Value ETF offers several compelling reasons. Firstly, Japanese small cap stocks have the potential for high growth, as these companies can be overlooked by larger investors, resulting in undervalued opportunities. Secondly, this ETF provides diversification within the small cap segment of the Japanese market, mitigating the risks associated with investing in individual stocks. Lastly, the Japan Small Cap Value ETF offers a cost-effective and efficient way to gain exposure to the dynamic Japanese small cap market.

🔍 Key Point: Investing in the Japan Small Cap Value ETF offers the potential for high growth, diversification within the small cap segment, and a cost-effective investment strategy.

How Can You Invest in Japan Small Cap Value ETF?

Investing in the Japan Small Cap Value ETF is a straightforward process. To start, you need to open a brokerage account or choose an investment platform that offers access to this ETF. Once you have the account set up, you can search for the Japan Small Cap Value ETF using its ticker symbol and place an order to buy shares. It is important to consider your investment goals, risk tolerance, and investment horizon when determining the amount to invest. Regular monitoring and periodic rebalancing may also be necessary to align your investment with your objectives.

🔍 Key Point: Investing in the Japan Small Cap Value ETF requires opening a brokerage account or choosing an investment platform and conducting regular monitoring to align your investment with your goals.

Advantages and Disadvantages of Investing in Japan Small Cap Value ETF

Advantages:

1. Growth Potential: The Japan Small Cap Value ETF offers exposure to companies with high growth potential, which can result in significant returns.

2. Diversification: This ETF provides investors with diversification within the small cap segment of the Japanese market, reducing the impact of individual stock performance.

3. Cost-Effectiveness: Investing in the Japan Small Cap Value ETF is a cost-effective way to gain exposure to the Japanese small cap market, avoiding the need to buy and manage individual stocks.

4. Liquidity: As an exchange-traded fund, the Japan Small Cap Value ETF offers liquidity, allowing investors to buy or sell shares on the stock exchange.

5. Professional Management: The Japan Small Cap Value ETF is managed by professionals who conduct thorough research and analysis to optimize the portfolio’s performance.

Disadvantages:

1. Volatility: Investing in small cap stocks can be more volatile compared to larger companies, resulting in higher fluctuations in the value of the ETF.

2. Market Risk: The performance of the Japan Small Cap Value ETF is influenced by market conditions, economic factors, and other external events, introducing inherent market risks.

3. Currency Risk: Investing in foreign markets, such as Japan, exposes investors to currency risk, as fluctuations in exchange rates can impact the value of the ETF.

🔍 Key Point: The Japan Small Cap Value ETF offers growth potential, diversification, cost-effectiveness, liquidity, but also carries risks such as volatility, market risk, and currency risk.

Frequently Asked Questions (FAQs)

1. Can I invest in the Japan Small Cap Value ETF through my regular brokerage account?

Yes, the Japan Small Cap Value ETF can typically be purchased through regular brokerage accounts or investment platforms.

2. What is the expense ratio of the Japan Small Cap Value ETF?

The expense ratio can vary depending on the specific ETF, so it is important to check with the provider or your financial advisor for the most up-to-date information.

3. Is the Japan Small Cap Value ETF suitable for short-term trading?

While the Japan Small Cap Value ETF can be traded on a short-term basis, it is generally recommended for investors with a long-term investment horizon to fully benefit from potential growth.

4. What are the tax implications of investing in the Japan Small Cap Value ETF?

The tax implications of investing in the Japan Small Cap Value ETF may vary depending on your country of residence. It is advisable to consult a tax professional or financial advisor for personalized guidance.

5. Can I reinvest dividends from the Japan Small Cap Value ETF?

Dividend reinvestment options may be available for the Japan Small Cap Value ETF. You can check with your brokerage or investment platform for details on dividend reinvestment programs.

Conclusion

In conclusion, the Japan Small Cap Value ETF presents an exciting opportunity for investors looking to tap into the potential of Japanese small cap stocks. With its focus on undervalued companies and the potential for high growth, this ETF offers a diversified and cost-effective approach to investing in the Japanese small cap market. However, it is important to consider the risks associated with small cap stocks and to conduct thorough research before making investment decisions.

We hope this article has provided you with valuable insights and information on the Japan Small Cap Value ETF. Now, it’s time for you to take action and explore the world of Japanese small cap investing!

Final Remarks

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be considered as financial advice. Investing in the stock market involves risks, and past performance is not indicative of future results. It is crucial to conduct thorough research and consult with a professional financial advisor before making investment decisions.

Remember to stay informed, diversify your portfolio, and invest responsibly.

This post topic: Japan